Vietnam Extends Deadline for Tax, Land Payments: Decree 52

Posted by Vietnam Briefing Written by Pritesh Samuel and Thang Vu

- Vietnam issued Decree 52 on April 19 to defer payments on tax and land fee rentals, similar to Decree 41 last year.

- The Decree applies to the same business organizations as in Decree 41, but also additional business sectors such as beverages, mining, computer programming, and consulting.

- Investors should study the Decree carefully to ensure they are in compliance to take advantage of the extensions.

Similar to last year, the government issued Decree 52/2020/ND-CP (Decree 52) on the extension of deadlines for the payments of taxes and land rental fees for the 2021 tax year. Decree 52 took effect on April 19 and is similar to Decree 41 last year, which catered to businesses affected by the pandemic.

Who is eligible?

In addition to business organizations that were eligible as per Decree 41 last year, Decree 52 also lists additional businesses that are eligible for the tax extension. Some of these include:

- Publishing activities and music;

- Crude oil and natural gas;

- Manufacture of beverages, printing, copying, motorbike manufacturing, prefabricated material, chemical production;

- Drainage and water treatment;

- Radio and television, computer programming and consulting; and

- Mining activities.

How are the deadlines for tax payment extended?

Eligible taxpayers are granted specific extensions on tax payments as follows:

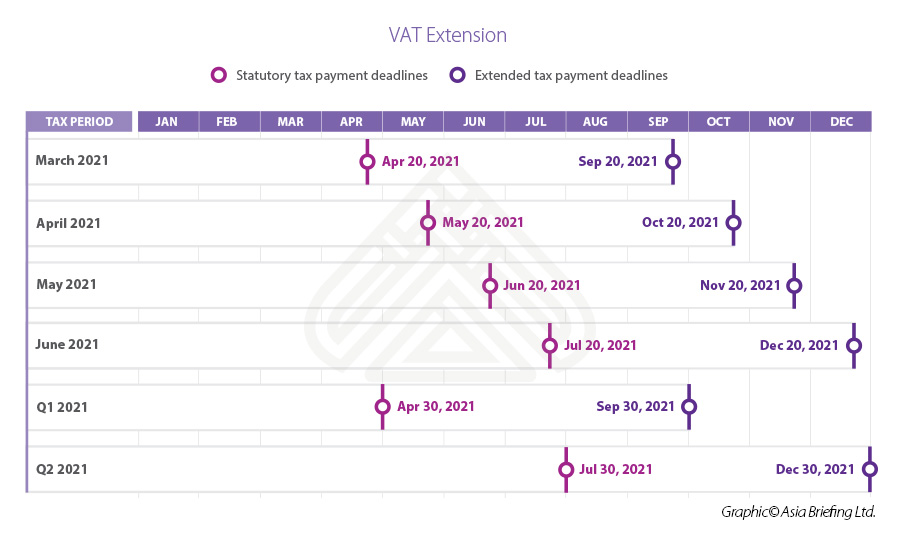

Value Added Tax (VAT)

Eligible taxpayers will be granted a five-month deferral:

Corporate Income Tax (CIT)

CIT payments for Q1 and Q2 will be extended by three months. So, for example, payment of Q1 CIT would be due by July 30, 2021. Of note, taxpayers should still consider the 75 percent rule when making provisional CIT remittances.

VAT and PIT for individuals and business households

The deadline for payment for VAT and PIT for individuals and business households such as SMEs will be extended to December 31, 2021.

Land lease

The deadline for payment of land lease for the first period of 2021 will be deferred for five months from May 31, 2021.

Procedures for the extension of tax payments

It is important to note that the tax deferral is not applied automatically, rather the eligible taxpayers must prepare and submit an application for tax and land rent deferral (either electronically, such as the form in Decree 52, or hard copy using the postal service) to the managing tax authority for their consideration.

The deadline for submitting a tax and land lease deferral application is July 30, 2021. Any submission after this date will be considered overdue and will be subject to rejection by the tax authorities.

Taxpayers will be responsible for doing a self-assessment of their eligibility for deferment of tax payments and tax authorities do not have to inform businesses whether their application is accepted.

If taxpayers are found to be ineligible for deferment of tax and land lease payments in future tax audits, they will be subject to interest penalties for late payments by tax authorities.

Therefore, businesses should maintain enough evidence to justify their eligibility to mitigate the risks of any future tax payments and interest penalties. Firms are advised to seek professional advice to ensure they can take advantage of Decree 52 but also remain compliant.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to [email protected] for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.